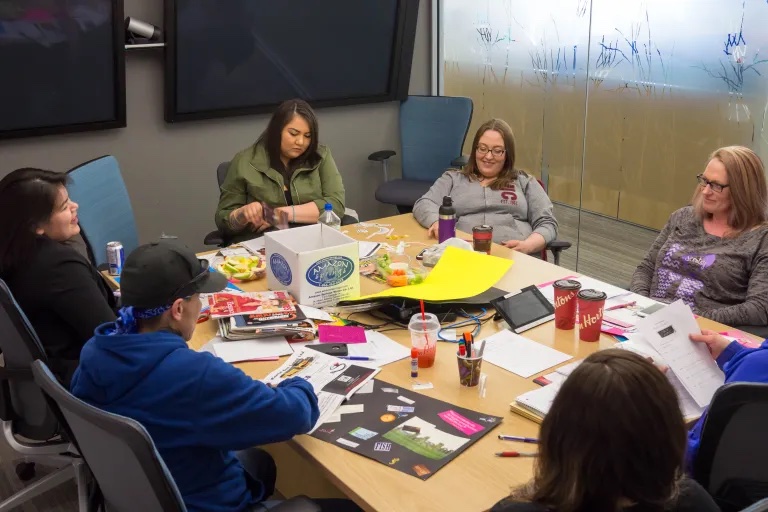

The Financial Independence Training (FIT) program addresses poverty in a cultural context by building skills and confidence in women and girls. As part of the Empower U collaborative, participants’ savings are matched to increase their ability to learn, build, or save.

The Empower U – FIT program explores our relationship with money and its link to trauma and addiction. One- and two-day workshops are available for a company’s employees or communities. And free training is available on how to facilitate the program in your own community.